It's been quite a few weeks that P6 continues to be in consolidation. This Stage of long waiting is just not fun anymore. :( But our market needed to breathe from the long steep uptrend. We need this to continue being bullish.So let's just take this positively.

So why not take time off from the market? Christmas is in the air and it comes once a year, if we need to be away from the market to enjoy, then by all means let's do it!

I am updating this post from my hometown, where internet is not so accessible, so expect my posts to be in vacation mode too.

Merry Christmas Everyone. In this phase in trading, don't forget to continue to give more this Christmas!

".... It is in giving the we receive, it is in dying that we are raised to eternal life. And of course, it is in consolidation that we gain more momentum to a bullish trend! "

Ayo ayo!

Wednesday, December 19, 2007

Let's enjoy Christmas and New Year

Posted by

MoneyBullsEye

at

5:51 AM

0

comments

![]()

Wednesday, December 12, 2007

PA revisited

PA is still in consolidation. The breakout that we saw last Dec. 03, 2007 was a false breakout. However this issue is not doomed yet. It is still trading within the range. If this breaks out at .265 level, our target is set to 0.38. Watch closely

Posted by

MoneyBullsEye

at

9:52 AM

0

comments

![]()

Monday, December 10, 2007

Ho Ho Ho !!! MICrry Christmas!!!

Last October 25, 2007, Big MIC Triangle was seen forming from June. It looked impossible and ugly that time. But now it is forming very pretty. I almost forget about this big triangle since I am much focused on the smaller one with 11.50 target.

As one of the members of the Absolute Traders Cebu, Sir Hans Chu reminded me of my posted big Triangle two months ago, I realize there is bigger reward to be considered on MIC. Diminishing volume is clearly shown on the weekly chart. Swapang!! See, it has new target price of 16.50!Reasonable Swapang, I may say. Just timely for Christmas!!

So, plan ahead as you establish your entry point on MIC. Fundamentally, it is also expecting good news very soon!

Posted by

MoneyBullsEye

at

2:19 AM

0

comments

![]()

Wednesday, December 5, 2007

ELI 'd Wizard break that spell ! ! !

Eli had been from a very long term consolidation from 1999 - 2007, wow it was a long sleep! Hibernation eh?!

It's cup and handle with the smiling volume,has bottomed to .12 and now it come out from it's triangle handle at 0.81. TP from that breakout is about 1.14.

But hey, we have another pattern to watch here,just before the TP from the triangle is reached at 1.14, the cup has another breakout 1.0! Please please hold you breath, this is pretty exciting!!! TP for Cup and Handle is 1.83

WATCH over this stock and trade it nicely! ! The spell from being sleeping beauty has been broken!

You must have gotten in at .83, but I went in at 0.87, thanks to my community's heads up, kadong, james and yves. Whew! I could have missed this! Mabuhay ang cebu batch 3!

Posted by

MoneyBullsEye

at

1:13 PM

0

comments

![]()

Tuesday, December 4, 2007

Learning Technical Analysis Isn't that hard, Is it?

Look at the smiles of our Absolute Traders new batch in Cebu! Wow, they just proved that TA is not a difficult thing to learn! It just need some dedication, jumpstart training and the community to guide you through!

Congratulations to Cebu Batch 3. I am very proud of you all, finishing the 3-day classes with more deligence and enthusiasm.

Continue making more money! Cebu Batch 4, see you in 2008!

Posted by

MoneyBullsEye

at

11:18 AM

0

comments

![]()

Labels: TA Insights

Sunday, December 2, 2007

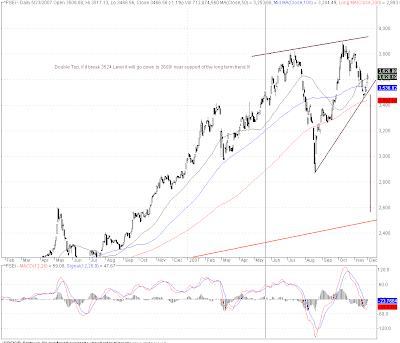

PSEi Watch - December 03, 2007

In trading any markets in the World, indexes should be checked regularly to know the health of the market in general.

For PSE trading, PSE index is indeed a good barometer in checking the sentiments of our entire exchange.

Technical Analysis is subjective, that is why it is most effective when practiced with the group of the same background, to discuss possibilities.

We have seen two formations on the consolidation phase of the PSEi: Reverse Head and Shoulder and Double Top. R HandS is Bullish while Double Top is bearish.

This is something to watch.

Double TOP: If support 3520 level is broken. A target of 2560 level near long term trend line is possible. We have to watch out and be careful with our trades.

Reverse Head and Shoulder: If Resistance at 3940 is broken, we will be looking forward for 4900 level. Of course, this will not be a straight line thing. Volatility and the time frame should be considered here. The consolidation phase from February to December 2007 is about 10 months, and may continue until next year. Targets should also be about that time to complete. So remember that targets are not magically achieved. It has time element to consider.

Keep your technical eyes open and be responsible on the hard earned money you are trading!

Posted by

MoneyBullsEye

at

10:57 PM

0

comments

![]()

Monday, November 26, 2007

PAy attention to triangles

Another triangle pattern to watch! This time it's perfectly perfect! The Volume is deminishing! MA is not dacing! Respecting the fast one to be above the medium and the slow one.

PAy attention and get in at .24!!! Pila na! .24 lang don't ever forget your cut loss if it goes back in the triangle. Target .36.

Good luck.

Posted by

MoneyBullsEye

at

8:50 PM

3

comments

![]()

Hello MIC Test!

I shall confess my ipit! :)

I have mic at 8.2 average price, it is running 6.5 now.

I am suppose to sell it at rally somewhere at 7.0,

but gee, a pattern is about to confirm!

TRIANGLE! Symmetrical as it is, looks strong and sexy!

The MA's are confirming that it is still in consolidation

state, but nearing to breakout! Watch out if

it breaks at 7.0, buy at 7.1 ! If it goes back to the triangle,

cut at 6.9.

Target? 11.5, wow ! Hopefully this time it will reach the target price!

If it won't i will immediately sell at the first sign of weakness after

breakout.

Posted by

MoneyBullsEye

at

1:43 AM

0

comments

![]()

Thursday, November 15, 2007

Absolute Traders: Stikes 3 in Cebu !

Absolute Traders have been coming to Cebu since August,2007 for Technical Analysis Seminar.

I am very fortunate to be part of Cebu Batch 1 and more lucky to be in the community!

Cebu(including Visayas and Midanao) members have impressed Absolute Traders on how dedicated, active, focused the BISDAK members are. The 3-day seminar they have conducted so far for the 2 batches were very successful and fruitful.

Since the community is continuously building in Cebu, the communication with all the members is also continues on our daily skype chats and forums.

Sharing is never difficult, since all the traders are in the same pace and the same mind set. All are technicians, as trained. I believe this is the reason why Absolute Traders require each member to undergo the 3-day TA seminar. Likewise a jumpstart for Learning Technical Analysis.

We do not just talk about stocks, but also socialize while reviewing the market through our Chart Analysis Forums. Our First Cebu CAF was a success with the attendance of Batch 1 and Batch 2 at Mooon Cafe.

Our 3rd Batch in Cebu is on our way, November 23 - 25, 2007. Cebu Chart Analysis Forum - November 24, 2007, Mr. A, Busay.

November 23rd Class is from 7:00PM - 10:00PM

While Both November 24 and 25 are from 9:00AM - 5:00PM.

For more details and inquiries on Cebu Batch 3, email: cebuseminar@absolutetraders.com

or Visit: www.absolutetraders.com

To give you a glimpse of our Cebu community members.

Batch 1:

Batch 2

Posted by

MoneyBullsEye

at

8:09 AM

0

comments

![]()

Sunday, November 11, 2007

sTAr Light sTAr bright let me raise my Flag tonight!

Another issue to watch on Flag.

I am still holding my TA at the target 2.8 based on Cup and handle,but that was not reached. The Price retrace and looks like going down. I was planning to sell it at a little profit or at a little loss.

I thought it will fail, but it seems that I am wrong. TA looks like forming a flag. Pefect beAutiful one.That might realize my target at 2.7 - 2.8. Last 11/07/07 it signaled to go up to break the resistance of the flag but decide to go down again. It just formed another bounce that made the flag even more sexy.

If I am buying at a breakout of this flag, the price above 2.0 is a buy for me. In my opinion, this will continue to dance with the oil prices' moves.Just a warning to my readers, flag are the most difficult to trade, it may not reach the target and quick to retrace, you have to absolutely determine you exit and entry point.

If it goes out above 2.0 and retrace too early sell at a loss. Maximum target is 2.7 but have to watch for market momentum to hold on or not.

TA Flag :

TA Cup and Handle:

Posted by

MoneyBullsEye

at

9:37 AM

0

comments

![]()

Labels: PSE STOCKS

Friday, November 9, 2007

Flags that fly me to the moon or drag me down the quicksand

I do like Flags and I trade them often, but why most traders don't? It's my Absolute Traders mentor, Boss B's expertise, while my teachers Danny and Hanson's least traded pattern.

Flags and Pennants are the quickest to trade. It takes about 1 wk - 2 wks to complete or fail. Flags might look like a flag, but sometimes turn into a reversal pattern. Your entries on flags are very important and crucial. If you enter too early and it goes down, you are stuck!

Actual Flag patterns can look very different and odd compared to book descriptions, but they could still be valid ones.

I have been posting flags lately, I am hoping that you will trade cautiously and recognize stops and selling below targets. :)

Flags are not for faint-hearted traders, the risk is greater, but the returns are quick.

Decide for yourself and may take a greater risk.

Ayo ayo!

Posted by

MoneyBullsEye

at

11:09 AM

0

comments

![]()

Labels: TA Insights

Wednesday, November 7, 2007

Longterm FGEN outlook

If we look at FGEN's trend line from Aug. 2006 it has never been breached! The Movement of prices looks sexy too!

On a medium term, current consolidation from Aug 2007 gives us a hind sight of a huge ascending triangle breaking out soon. MA's are still dancing with each other which confirms the consolidation face.

This is something to watch, and if you a long term investor, it looks good for you. :)

And if you are a brave soul, current price looks like a bottom price to complete that triangle and a price that goes away from the support. :)

Posted by

MoneyBullsEye

at

9:48 AM

0

comments

![]()

Labels: PSE STOCKS

Tuesday, November 6, 2007

IPVG direction please?

My friend AgentT ask me to look at IPVG, where is it heading?

It's one year trend is still intact, at a very healthy 45 degree slope.

Previous channel from Feb - Jul , 2007 seems to be repeated from August to date.

After Feb - July channel, it went up to 11.50 and went down again to consolidation. Assuming history will repeat itself for IPVG , mirroring that previous price action, it could go as high as 13.50 when it breaks at 9.0. If I enter IPVG I should plant the bomb at 9.0. So I won't explode with my own planted bomb.

Good luck !

By tradingbless at 2007-11-07

Posted by

MoneyBullsEye

at

11:14 PM

0

comments

![]()

Labels: PSE STOCKS

Monday, November 5, 2007

Another Round of Flag Raising for DIZ ?

A sleeping issue, that's revived by JAP! When he visited Cebu with CKP last October 12, he announced that they are supporting DIZ for some high grade minerals yet to be processed.

After that announcement in Cebu, DIZ came out from the grave with the first flag formation, TP was 13.50 by then, it reached as high as 11.50 and retreated. now another flag is forming at 14.50 TP. my buy point is 10 .50 - 11.00.

By tradingbless at 2007-11-05

Posted by

MoneyBullsEye

at

8:41 PM

0

comments

![]()

Labels: PSE STOCKS

AT last Rising Sun for this Mining Issue?

Few of my friends at p6chat has been very bullish at AT. Some already accumulated and still waiting. Some fundamental shows several activities going on at the Carmen Copper Mine in Toledo. The community is alive again! However, I'd still rather stick to my Technical Analysis outlook.

I am seeing Reverse H and Shoulder at the chart, breakout at 16.50, proper buy at 16.75 with the support of volume. TP = 23.50 Good to watch . . . .

By tradingbless at 2007-11-05

Posted by

MoneyBullsEye

at

4:30 PM

0

comments

![]()

Labels: PSE STOCKS

Saturday, November 3, 2007

PERCfect Rectangular Breakout!

I have been watching PERC for quite a while, just last 2 weeks It has attempted to get out from it's rectagular pattern, but went back down again and stayed inside the rectangle for quite a little while.

With the aggresive movement of oil prices from the global market, I assumed to see price breakout from the pattern soon. I did a dangerous move! A no-no attitude for a technician, but I still did anyway. I took a position at 10.75 and 11.25, these prices are still inside the rectangular pattern, the correct buying point should be 12.00 after the breakout at 11.75. Good thing the oil prices continue to move up that PERC's price followed.

Let's look at PERC's pattern first. It was consolidating for about a year inside a PERCfect rectangle with the resistance of 11.75. The dancing of 50-day, 100-day, 200-day MAs with each other confirmed the perfect consolidation. That shows that the position I took was dangerous, the pattern might break the resistance at 11.75 or break the support at 9.0. This does not have specific direction, bullish or bearish.

PERC went up and closed to 13.25 on its breakout date, however last Tuesday, October 31, it pulled back to 12.00. Scary huh? Good thing there was no trading for 3 days.

Here is my action plan, watch the price to reach the target at 14.50. Sell if the sign of weakness after 14.50 is seen. Hold if the momentum is still good. Tolerable pullback after the TP is reached is only 14.00, if it goes below SELL! Before the target is reached, if price weakens and goes back inside the rectangle, sell at 11.50 a minimum profit.

Since it has pulled back last week and closed at 12, I think if it opens at that price on Monday, November 05, it is a good price to buy for a 14.50 target. But please please dont ever forget your stops!

By tradingbless at 2007-11-03

Posted by

MoneyBullsEye

at

11:15 AM

2

comments

![]()

Labels: PSE STOCKS

Thursday, November 1, 2007

Money in the Internet - Thanks to Cebu PMT EB

October 23, 2007 - Baseline Restaurant Cebu City. I joined the first Pinoy Money Talk Eye Ball of 13 individuals. I was amazed with various people i met. They knew countless ways to make money!

Name it and you'll see a lot of answers from that crowd of 13! Mutual Funds, Stock, Banks, Stocks, Affiliate Marketing, money from the internet, financial services, etc, etc!

We have financial managers, bank owners, stock traders/investors, affiliate marketing experts, ad gurus, in short we have all the money makers in one busy discussion! You can see the enthusiasm, interest and emotions!

Of all types of money makers infront of me, where information is readily available. Money in the internet catched my greater interest. Why? It's easy, accessible, global, everywhere, endless!

I am writing this piece to share to you some links where you could take big bucks, if you have time updating your friendster, you should have more time browsing for money! Answer some surveys, click some ads, put some ads to yout blogs or websites, invite more people to join your team, grow your circle.

For some money makers ads ( and there are countless of them out there, just need your patience) :

https://www.google.com/adsense

For more money making topics check this link:

http://www.pinoymoneytalk.com/2007/02/22/how-pinoys-earn-money-online/

In conclusion, there are endless opportunities to make money over the internet, we just need to start it out, pursue opportunities, have a little patience on nitty gritty things, it's just like starting to learn chopsticks or going to the gym.

Posted by

MoneyBullsEye

at

12:05 PM

2

comments

![]()

Labels: PSE STOCKS

Technical Analysis My Trading Tool

Posted by

MoneyBullsEye

at

9:54 AM

0

comments

![]()

Labels: TA Insights