In trading any markets in the World, indexes should be checked regularly to know the health of the market in general.

For PSE trading, PSE index is indeed a good barometer in checking the sentiments of our entire exchange.

Technical Analysis is subjective, that is why it is most effective when practiced with the group of the same background, to discuss possibilities.

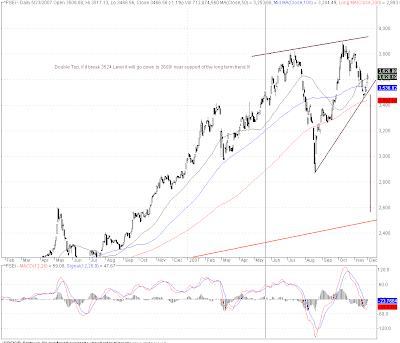

We have seen two formations on the consolidation phase of the PSEi: Reverse Head and Shoulder and Double Top. R HandS is Bullish while Double Top is bearish.

This is something to watch.

Double TOP: If support 3520 level is broken. A target of 2560 level near long term trend line is possible. We have to watch out and be careful with our trades.

Reverse Head and Shoulder: If Resistance at 3940 is broken, we will be looking forward for 4900 level. Of course, this will not be a straight line thing. Volatility and the time frame should be considered here. The consolidation phase from February to December 2007 is about 10 months, and may continue until next year. Targets should also be about that time to complete. So remember that targets are not magically achieved. It has time element to consider.

Keep your technical eyes open and be responsible on the hard earned money you are trading!

Sunday, December 2, 2007

PSEi Watch - December 03, 2007

Posted by

MoneyBullsEye

at

10:57 PM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment